ATM crime continues to proliferate

Printable pdf: SafeAlert ATM Crime Proliferates-SA21

We first reported a significant increase in ATM smash and grab style claims two years ago. Unfortunately, criminals continue to target ATMs at an alarming pace, hitting machines across the country in numbers never seen before. Nearly 50 ATM claims were reported in 2022, up from 30 in 2021 and under ten in 2020. Claims were reported in 22 different states, with Texas, Louisiana, Mississippi, and Georgia leading the way.

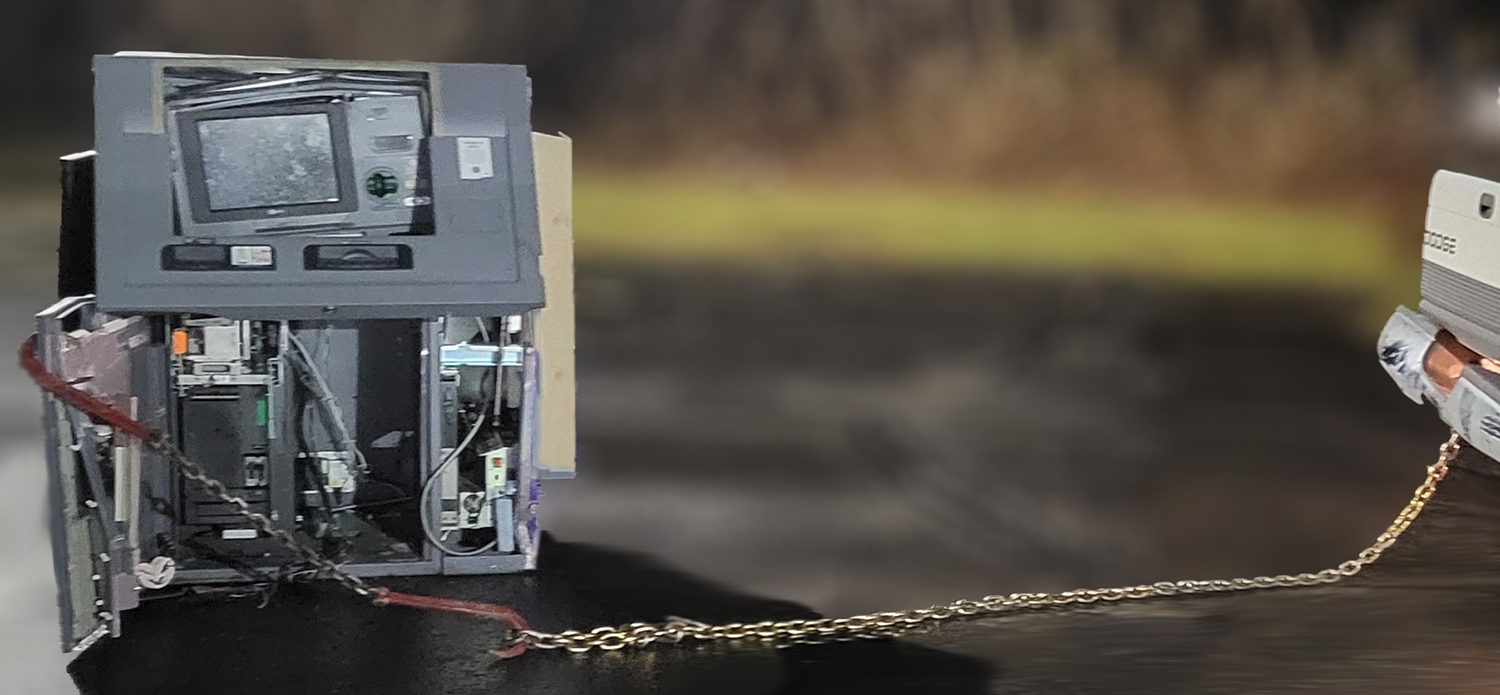

Overwhelmingly, the most common scenario is the “hook and chain” attack, where thieves rip an ATM

open with a hook and chain attached to a large vehicle. Once open, thieves remove the cash cassettes and flee the scene, leaving the damaged or destroyed machine behind. In other cases, vehicles are used to breach exterior walls or doors to gain

access to ATMs placed inside. These crimes are prolific because they are profitable and easy to conduct.

Overwhelmingly, the most common scenario is the “hook and chain” attack, where thieves rip an ATM

open with a hook and chain attached to a large vehicle. Once open, thieves remove the cash cassettes and flee the scene, leaving the damaged or destroyed machine behind. In other cases, vehicles are used to breach exterior walls or doors to gain

access to ATMs placed inside. These crimes are prolific because they are profitable and easy to conduct.

ATM crime is particularly problematic from an insurance perspective because these crimes trigger coverage under multiple policies. Your financial institution bond responds to the stolen cash and your property policy responds to the damaged ATM. Based on our data, the average amount of cash stolen in a hook and chain attack is $27,000, and it typically costs around $75,000 to replace a machine.

There are steps that can be taken to mitigate exposure to ATM crime. In addition to enhanced lighting, cameras, and audible alarms, experts suggest physical barriers can be particularly effective. Bollards, cross bars, and ATM security gates are commonly used to deter theft. Some banks also use steel or concrete enclosures to help withstand attacks.

Innovative technologies, including the use of traceable liquid solutions, are beginning to gain popularity. Here, harmless liquid solutions are sprayed onto a criminal using a specially designed sprayer inserted into an ATM. The solution is only detectable under black light and can remain visible for long periods of time. Each solution has its own signature formula, allowing for a unique sequence that can be traced back to a particular machine.

Another emerging solution is the use of specially designed dye packs that can be set to deploy when the machine is hit with a certain level of force, similar to the technology behind vehicle air bags. These dye packs sit inside the ATM alongside the cash canisters but do not take up valuable space in the canisters themselves. The moment enough force is detected, the dye packs explode rendering the cash useless.

Regardless of your security protocols, you should conduct regular risk assessments to identify potential vulnerabilities and threats to your physical assets. An annual audit of your ATM security measures is a good proactive step to help deter threats from hook and chain or other security breaches.

66e06ecd-f855-4119-b784-193811937ddc.svg?Status=Master&sfvrsn=448913a7_3/

ABAIS-Logo-1-(1)66e06ecd-f855-4119-b784-193811937ddc

.svg)