Check Writing Decreased, yet Check Fraud Increased

Printable pdf: SafeTalk:Check Writing Decreased, yet Check Fraud Increased ST12

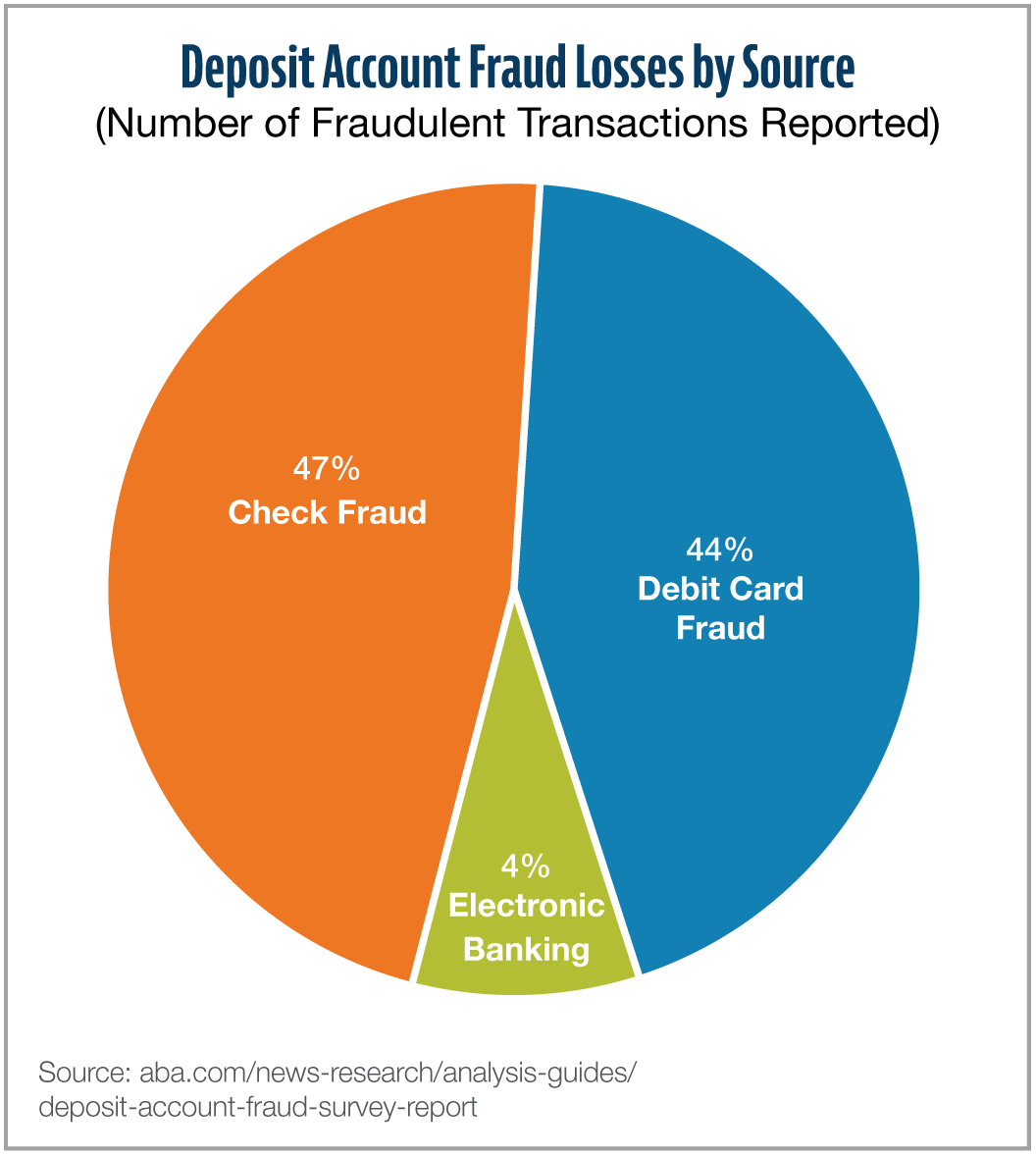

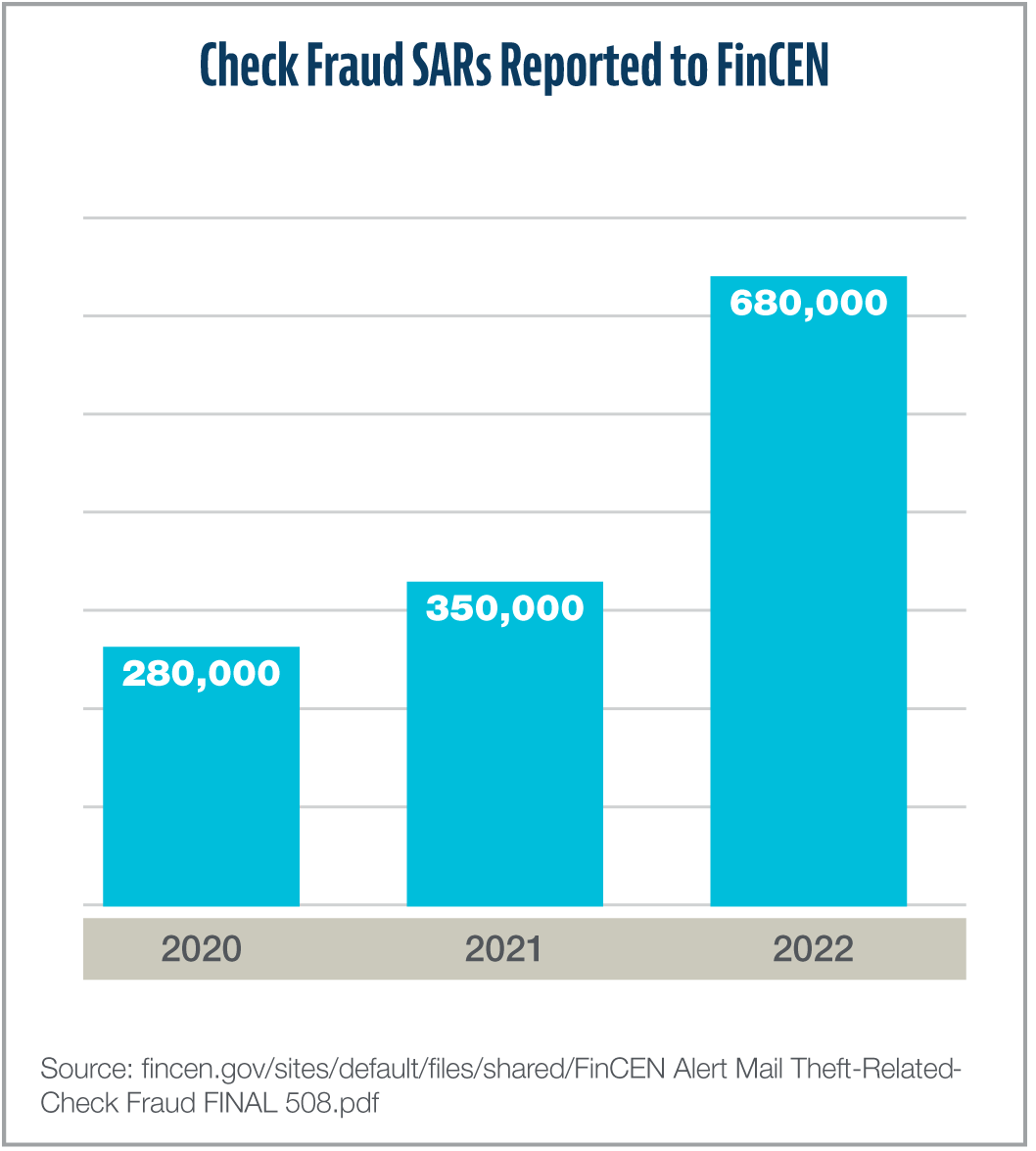

While check use has dropped a whopping 82% over the past 30 years, check fraud remains the most common type of depository fraud and very popular form of criminal activity because it is low-tech and presents a huge pool of victims, with over 11 billion

checks still written each year. It is estimated to cost financial institutions over $1 billion in losses.

The good news: banks stop most check fraud attempts through sound control practices like these:

| Altered Check / Forged Signatures | Counterfeit Check | Drawn on Closed Account |

|

|

|

Without solid controls, industry losses would hit $10 billion a year instead of just $1 billion. |

When controls don’t prevent check fraud...

In the event your bank becomes the victim of check fraud, your state’s UCC rules apply. Under the UCC, the liability for an altered, counterfeit or forged check can reside with the customer drawing the check, the bank of first deposit (BOFD), or the drawee bank depending on the nature of the fraud:

- Altered Check. If the check amount of the check is altered from the original maker’s intent, the BOFD is liable and the drawee bank can file a Breach of Warranty claim against the BOFD to recoup the loss.

- Counterfeit Check. If the check itself is counterfeit, the drawee bank holds liability, although the drawee bank could attempt to hold the customer accountable if he or she failed to report the counterfeit check within the allotted timeframe according to the account holder agreement.

- Forged Endorsement. If the signature on the back of the check is missing, incomplete or forged, the bank of first deposit is liable as it warrants the validity of the endorsement to the drawee bank, and the drawee bank can file a Breach of Warranty claim against the BOFD to recoup the loss.

- Forged Signature. If the signature on the back of the check is forged, the drawee bank is liable, though again, the bank could attempt to hold the customer accountable if he or she failed to meet the notification requirements in the account holder agreement.

The ABA Check Fraud Claim Directory helps banks resolve check fraud claims

To help drawee bank recoup lost funds through the Breach of Warranty check claim process, the ABA (American Bankers Association) created the Check Fraud Claim Directory to help banks quickly resolve check fraud claims. The directory provides contact information for those bank employees responsible for clearing check warranty breach claim submitted by another financial institution. The directory is searchable by bank name, city, state or FDIC number so banks can easily find a person or email address at the bank to help resolve a warranty breach claim.

Did you know...? Through its check fraud working group, the ABA has several initiatives underway to improve the overall check warranty breach claims process including:

|

66e06ecd-f855-4119-b784-193811937ddc.svg?Status=Master&sfvrsn=448913a7_3/

ABAIS-Logo-1-(1)66e06ecd-f855-4119-b784-193811937ddc

.svg)